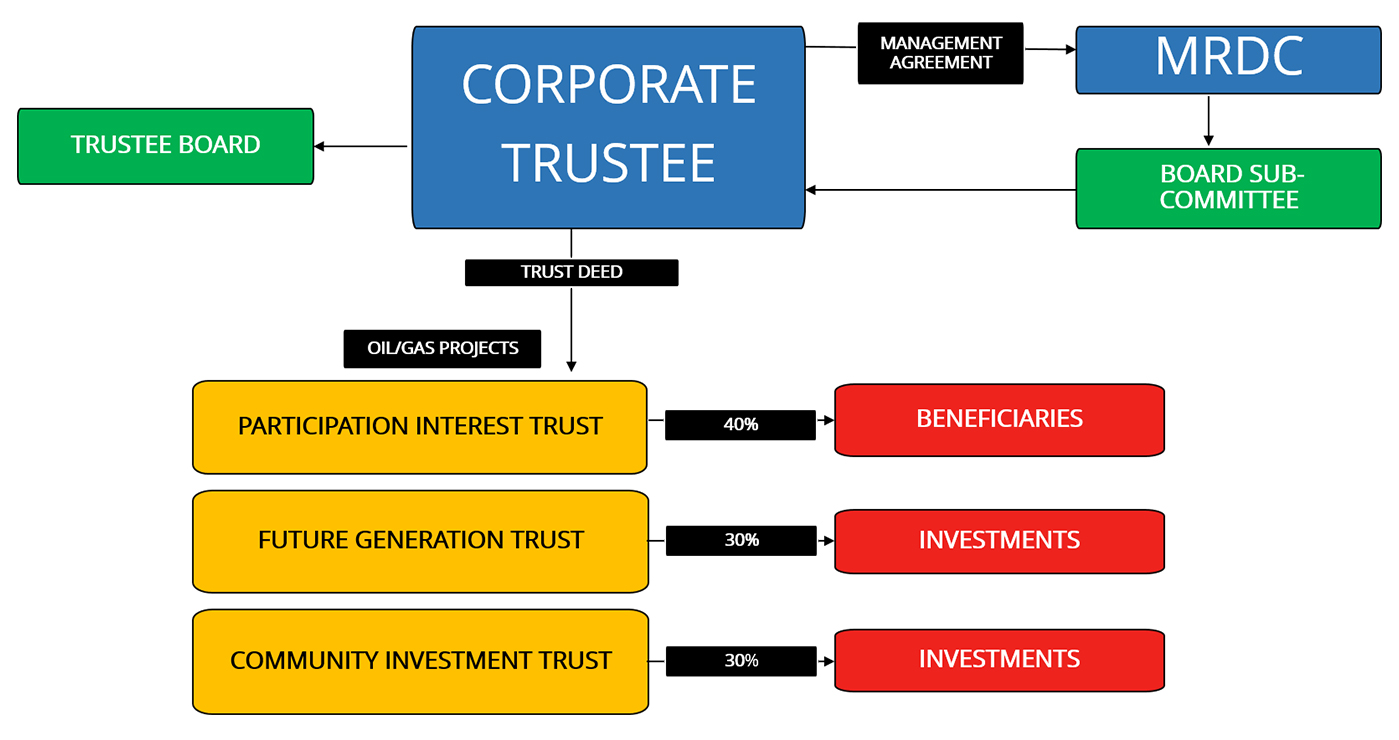

Trust Structure

Why Trust Arrangements?

Who is the Trustee?

Under the Oil and Gas Act 1998 the Trustee of the Trusts must be a company. It is requirement in the law that this company is a wholly owned subsidiary company of MRDC. That MRDC subsidiary company is therefore the corporate trustee. The corporate trustee acts through its Board of Directors.

Board of Directors

The Oil and Gas Act requires that the Board of directors for the corporate trustees comprise of:

- State representatives, in the majority; and

- Landowner representatives, in the minority.

Directors who represent the landowners on the Board of the Trustee Company are to be elected by the landowners through their clans’ executives. The landowner directors’ term in office is 4 years. Once the term expires then they cease to hold office and the landowner clans elect their representatives to the Boards.It is also an important requirement the Directors representing the landowners must reside in the project area communities.The Directors on the board of the corporate trustees are not trustees in their individual capacity.The activities and management of these trusts are set out in a Trust Deed – the document that identifies the name of the trust(s), the trustee and the beneficiaries of the trust(s). The Trust Deed also provides the rules under which the trust is operated and managed.

Trust Deed and Guidelines

The Trust Deeds have very specific guidelines for the management of the funds. The guidelines provide for the investment, management and accounting of the equity and royalty funds.The Trust Deeds allow the trustee to distribute a percentage of the trust funds to the beneficiaries.Furthermore, the guidelines in the Trust Deeds ensure that the landowner moneys in the trusts are invested in business ventures and projects that can generate acceptable returns which will increase the value of the Trusts.One of the Trusts also allows for investment in certain infrastructure to improve the quality of life for the people in the project area whilst at the same time undertaking long term investments to create revenue sources for the next generation who may not have the current projects operating to create benefits.

The Trust Structure

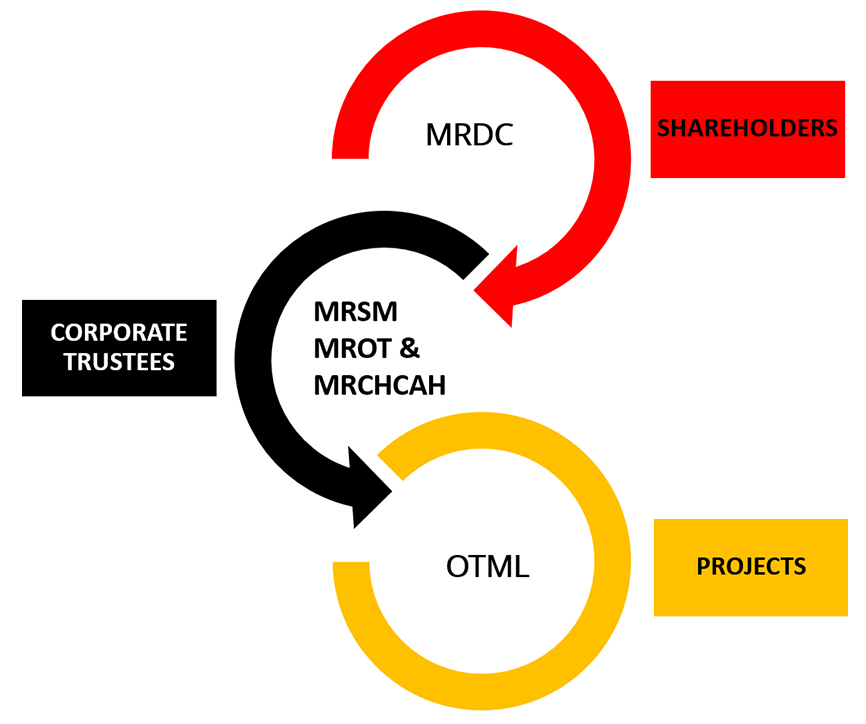

Similarly, the subsidiaries participating in the mining sector have a trust role to manage equity proceeds from the various mining projects in the country. The trust arrangements for the mining benefits is captured in agreements because the current Mining Act does not contain provisions similar to the Oil and Gas Act.

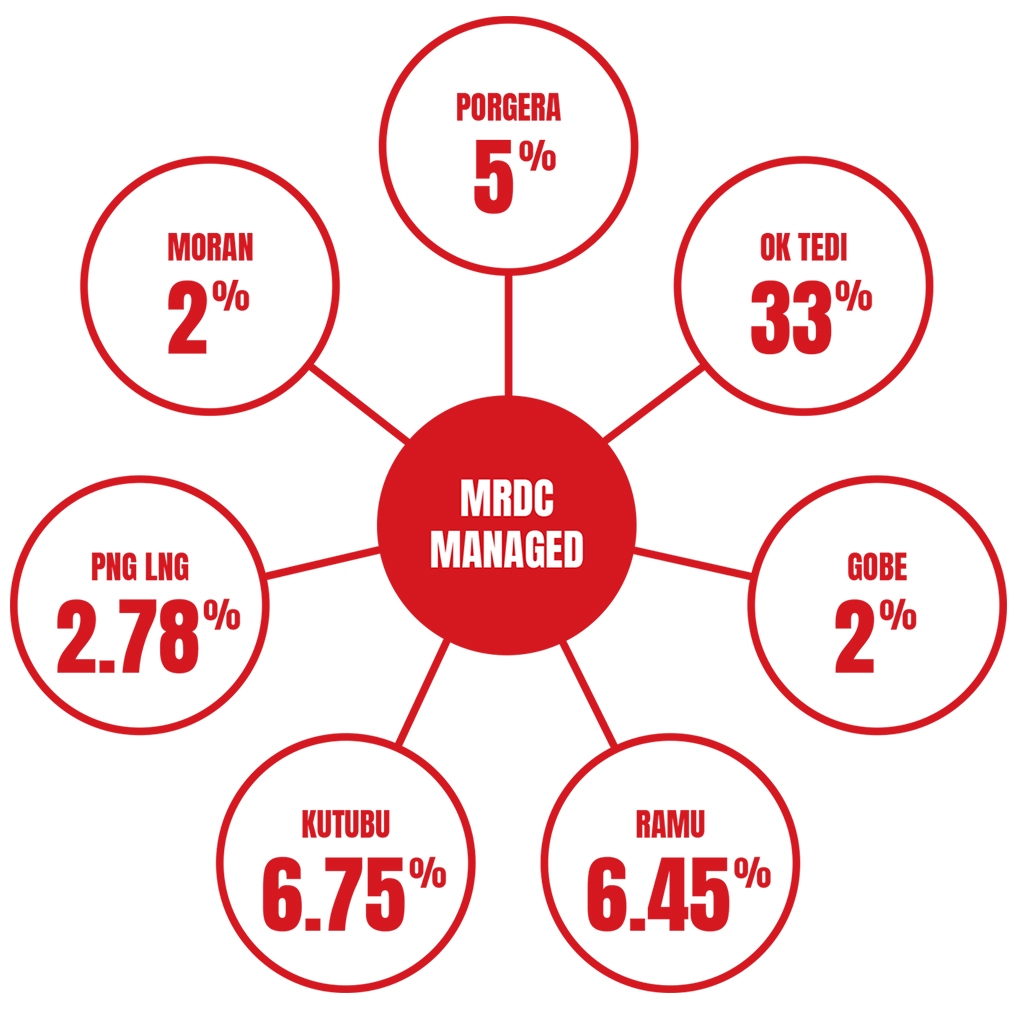

Interests Under Management